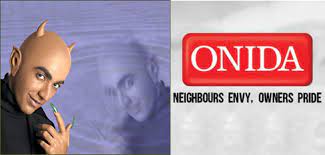

In the world of investments, it’s not uncommon for people to look at their neighbor’s or friend’s portfolio and feel a pang of envy. The desire to replicate someone else’s success can be tempting, especially when the returns seem impressive. However, this envy-driven investment strategy often leads to disappointment and financial pitfalls.

The Mirage of Replicating Success:

Many investors fall into the trap of copying a friend or family member’s investment portfolio, hoping to achieve the same stellar returns. What they fail to realize is that behind every successful portfolio lies a unique set of circumstances and risk tolerance. Investors become blinded by the allure of high returns, neglecting the fact that the risk taken to generate those returns might not align with their own financial situation.

Individual Differences Matter:

Every individual goes through distinct life experiences and faces unique challenges. Factors such as financial situations, dependents, marital status, and family responsibilities significantly differ from person to person. Trying to replicate someone else’s investment journey is akin to trying to live another person’s life, creating a significant disparity in risk-return equations.

The Timing Issue:

Attempting to mimic someone else’s portfolio comes with a crucial timing challenge. The person you’re emulating invested in their portfolio before you even knew about it, reaping the benefits early on. By the time you jump on the bandwagon, you might have missed the train, making it unlikely to achieve the same level of returns.

The Importance of Goal-Based Financial Planning:

To avoid falling into the envy trap, it’s crucial to engage in goal-based financial planning. This process helps align return expectations with the level of risk one is willing to undertake. By tailoring investments to specific financial and family situations, individuals can better navigate uncertainties and work toward achieving their goals and aspirations.

How to avoid making this mistake:

1. Congratulate the individual who has made great returns.

2. listen to their advice from one ear and remove it from the other ear.

3. Go to PlanMyGoal.com and take the first Step towards goal based planning.

4. Review. Rebalance. Relax.

Conclusion:

In the realm of investments, it’s crucial to celebrate others’ successes without succumbing to the temptation of replicating their strategies. Goal-based financial planning tailored to individual circumstances is the key to making informed investment decisions. By avoiding the envy trap and focusing on personalized financial goals, individuals can build a robust investment strategy that stands the test of time.